Private credit is quietly reshaping the finance industry, creating billionaires and keeping capital flowing where banks may have pulled back. Despite a rocky 2022, financial conditions have returned to pre-tightening levels, signaling economic health and potential market growth. In today’s FA Alpha Daily, we explore how private credit plays a key role in boosting investor confidence.

FA Alpha Daily

Powered by Valens Research

For decades, the biggest fortunes in finance were made by hedge fund titans, private equity giants, and corporate raiders.

These were the high-profile dealmakers who dominated public markets, making headlines with their bold trades and leveraged buyouts.

However, a quiet group is accumulating wealth today.

According to Bloomberg’s latest Billionaires Index, some of the fastest-growing fortunes in finance are no longer tied to hedge funds or private equity.

Instead, the new money-maker is the once-overlooked private credit, a booming sector where firms lend directly to businesses, bypassing traditional lenders such as banks and bond markets.

The numbers tell the story… private credit assets have tripled in a decade, reaching $1.6 trillion.

The Bloomberg Billionaires Index identified 18 private credit billionaires across seven private credit firms, collectively worth $61 billion.

The U.S. economy had everything going for it in 2021. GDP growth was surging. Liquidity was abundant. Financial conditions were looser than they’d been in years.

It was the perfect environment for stocks to soar. And they did with the S&P 500 climbing nearly 27% that year.

But then came 2022.

Inflation roared to a 40-year high, forcing the Federal Reserve into one of the most aggressive tightening cycles since the 1980s.

Liquidity dried up, credit markets seized and the S&P 500 suffered its worst annual decline since the Great Recession.

Investors braced for an economic downturn. But instead of a full-blown recession, we got something different—a rapid tightening of financial conditions that crushed stock valuations without fully breaking the economy.

Now, nearly two years later, we’re finally seeing the kind of backdrop that should have fueled a rally back in early 2022, if the wheels hadn’t come off.

For the first time since the Fed started raising rates, financial conditions have eased back to pre-tightening levels.

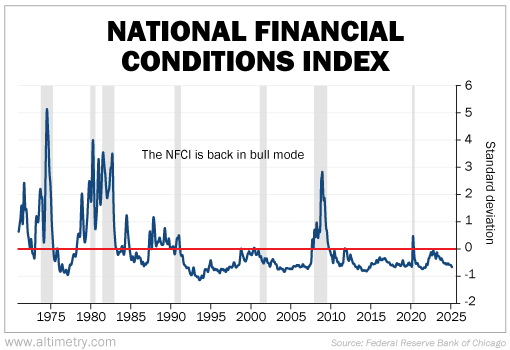

We can see this through the National Financial Conditions Index (“NFCI”), which tracks more than 100 financial metrics spanning risk, credit, and leverage.

The NFCI serves as a broad measure of financial stress in the system. When the index is above zero, conditions are tight—borrowing costs rise, lending slows, and liquidity dries up.

When it falls below zero, conditions are loose, making capital more available and markets more liquid.

As you can see in the following chart, the NFCI has been steadily loosening since March 2023.

It’s now well below zero, at levels last seen in late 2021, when markets were still in full bull mode.

Take a look…

Financial conditions have moved decisively into accommodative territory. That kind of shift typically supports economic expansion, rather than contraction, reinforcing the case for a continued bull market.

One of the biggest contributors to looser financial conditions is private credit.

That’s because private credit firms have been stepping in where banks have pulled back, keeping capital flowing to businesses, keeping them out of bankruptcy.

And as we explained previously, private credit has been growing rapidly, especially in the last decade, providing more capital for companies.

As private credit keeps creating wealth as shown by Bloomberg’s Billionaires Index, the sector will become more influential and will grow even more.

The booming in private credit signals strong liquidity in the economy and looser financial conditions that we can see through NSCI.

This isn’t the kind of easing we typically see in a downturn nor is it some kind of contrarian indicator that signals the good times are behind us.

Financial conditions like this signal a healthy economy. It’s a good sign for the stock market.

Investor optimism is rising, which means near-term volatility could pick up. But that’s not a signal to panic—it’s a signal to stay the course.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.